Market Update: What the Last Two Weeks Taught Us

December 5, 2025

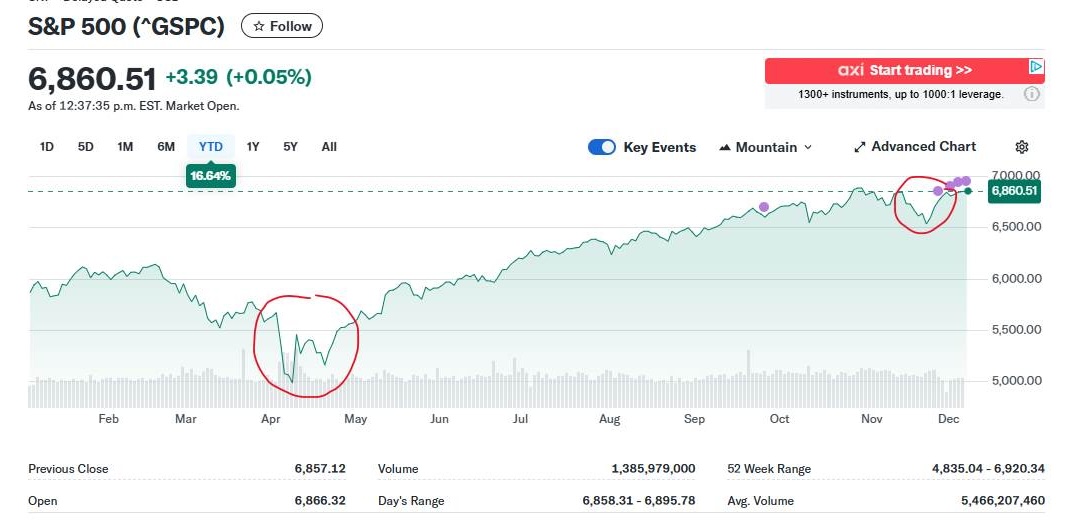

In late November, Matthew and I hosted a webinar on whether the AI rally had become a bubble. Headlines at the time were overwhelmingly negative. We saw stories about large hedge funds selling their AI holdings, sentiment had turned sharply lower, and the Fear & Greed Index had slipped into extreme fear. I was getting a lot of client questions about whether it was time to sell. Despite markets only being 5 to 6 percent off their highs, the mood was much worse than the numbers suggested.

My view then was that we were seeing a healthy pause, not the start of a crash. I said on CBC that if this volatility worried you, the best thing to do was close your eyes, avoid looking at your statements, and wait a month or two; chances were good we’d be back at or near all-time highs.

It didn’t take a month or two. As of December 5th, roughly two weeks later, North American markets are essentially right back to record levels.

There’s a lesson in this. We don’t need decades of market history to see how this plays out: we just have to look back to April. That drawdown was much larger—20 to 30 percent depending on the index—and sentiment was far worse. Yet that period turned out to be the single best buying opportunity of the year. In April I was pounding the table that the selloff was overdone. This recent pullback felt different. It wasn’t nearly as deep, markets had run much further, and the AI narrative genuinely needed some cooling off. To me it was more of a “do nothing” period rather than an opportunity to aggressively add.

A big part of the volatility was interest-rate expectations. In early November, markets had priced in a U.S. rate cut for December, which helped push indexes to previous highs. Then that probability suddenly collapsed—from roughly 70 percent down to about 20 percent. Markets don’t like it when liquidity is taken off the table. That shift alone triggered most of the weakness.

By the day of our webinar, odds had already risen back to about 40 percent, and I said then that I still expected the Fed to cut in December. That was against consensus at the time. Today, markets are pricing in about a 94 percent chance of a 25-basis-point cut. In other words, the rate cut is already fully priced in. When the announcement comes next Wednesday, the market reaction may be muted. If the Fed doesn’t cut—which is extremely unlikely—markets would fall. If they do cut, it could easily be a “sell-the-news” moment, because investors have already traded on the expectation.

This is why we don’t trade around short-term events. You can be right, you can be wrong, and either way the market can move irrationally. Our job at Foundation Wealth isn’t to predict every wiggle in the chart; it’s to generate strong long-term, risk-adjusted returns. The evidence overwhelmingly supports staying invested, maintaining discipline, and letting the long-term drivers of wealth creation do their work.

The stock market is often described as being “rigged,” but in a way that benefits long-term investors. Governments and central banks need healthy economies and rising tax revenues, and they have tools—especially liquidity and interest rates—that support markets over time. That doesn’t prevent drawdowns; those are simply the price of admission for higher long-term returns. But history consistently shows that discipline outweighs short-term trading.

Looking ahead, we continue to focus on big structural themes. One of the most important is energy. The global AI build-out requires enormous amounts of power, and both governments and corporations are racing to expand supply. That means increased investment in nuclear, natural gas, and especially solar, which has become inexpensive and fast to deploy. We’re watching opportunities in energy services as well; in fact, tradespeople like electricians may be among the most in-demand jobs of the next decade.

We also continue to like international stocks from a valuation standpoint and remain focused on global liquidity conditions, which ultimately drive markets more than headlines do.

As always, staying invested, staying disciplined, and avoiding emotional decision-making remain the core of our process. This year has offered two very clear reminders of why that approach works.”

Hope you find these helpful. As always, feel free to reach out with any questions or thoughts.

Best regards,

Mark, Leanne, and James

Book an appointment with Mark: https://calendly.com/mark-ting

Book an appointment with Leanne: https://calendly.com/leanne-brothers

Book an appointment with James: https://calendly.com/james-pelmore

Foundation Wealth Partners LP is registered as a Portfolio Manager and Exempt Market Dealer in all Canadian provinces and the Yukon Territory. Certain statements in this email are forward-looking. Forward-looking statements (“FLS”) are statements that are predictive in nature, depend on or refer to future events or conditions, or that include words such as “may,” “will,” “should,” “could,” “expect,” “anticipate,” intend,” “plan,” “believe,” “estimate” or other similar expressions. Statements that look forward in time or include anything other than historical information are subject to risks and uncertainties, and actual results, actions or events could differ materially from those set forth in the FLS. FLS are not guarantees of future performance and are by their nature based on numerous assumptions. Although the FLS contained in this document are based upon what Foundation Wealth Partners believe to be reasonable assumptions, Foundation Wealth Partners cannot assure that actual results will be consistent with these FLS. The reader is cautioned to consider the FLS carefully and not to place undue reliance on the FLS. Unless required by applicable law, it is not undertaken, and specifically disclaimed, that there is any intention or obligation to update or revise FLS, whether as a result of new information, future events or otherwise.