Guide to RESP Savings Strategies

September 1, 2025

Do you have a Registered Education Savings Plan (RESP) and you don’t quite know how it works? Are you sure that you’re using it to the fullest potential? Here’s some key information and a comparison between a variety of funding strategies, so you can make a more informed decision on what will work best for you.

RESP Key Terms

Subscriber(s): Owner(s) of the account

Beneficiary(ies): Student who will receive the benefit of savings in the account. Multiple students if the account has been set up as a Family RESP (Family RESPs provide extra flexibility when withdrawing!)

Assisted Contribution: A contribution to the RESP that attracts the Canada Education Savings Grant (CESG)

Non-assisted Contribution: A contribution to the RESP that is over the annual contribution limit, and so does not attract CESG

Grant: The Canada Education Savings Grant, which provides a 20% matching bonus to assisted contributions (every $5 you put in; government adds $1) for children through age 17.

Growth & Income: The value of the tax-sheltered investment returns inside the RESP

Education Assisted Payment (EAP): A withdrawal type made while a student is enrolled in post-secondary education. This type of withdrawal is made up of Grant, and Growth & Income, and is taxable to the Student.

Post-Secondary Education Payment (PSE): A withdrawal type made while a student is enrolled in post-secondary education. This type of withdrawal is made up of Contributions, and is non-taxable.

Non-Educational Capital Withdrawal: A non-taxable withdrawal of contributions paid to the subscriber. Making this type of withdrawal prior to the Grant portion being withdrawn by an eligible student will cause a clawback of the Grant.

RESP Key Amounts (all per-student)

Annual Assisted Contribution Room: $2,500 new annual room, or $5,000 maximum assisted annual contribution room using carry-forward.

Assisted Contribution Room Carry-forward: Any assisted contribution room that has not been used. This amount is cumulative and rolls forward.

Maximum Lifetime Assisted Contributions: $36,000

Maximum Lifetime Grant: $7,200 (being $36,000 x 20%)

Maximum Lifetime Total Contributions: $50,000 maximum, so up to $36,000 could be grant-assisted contributions, leaving $14,000 in unassisted contributions.

Methods of Funding an RESP

Standard Funding Model

This model is built around the idea of maximizing the assisted contributions annually from birth to age 17 to ensure all contributions attract the Grant amount. If you start right away, funding the RESP with $2,000 per year will maximize the grant dollars earned over the 18 years. Yes, your child begins earning Assisted Contribution room at birth, so a full 18 contribution years are available.

If you are able to start saving in the same year your child is born, and you are able to save less than $2,000 per year ($167/mo or $77 bi-weekly), the best practice would be to set up a regular savings schedule of a small amount, repeating often. Saving $25 or $50 bi-weekly will feel less impactful than a larger monthly or quarterly amount. Just starting? Aim a bit lower than you think and practice the habit of saving first. Once you’re confident that you won’t have to reduce or skip any contributions, increase the contribution amount.

If you are able to start saving in the same year your child is born, and you are able to save up to $2,500 per year (or consider maximizing assisted contributions as your gift to your student) limit your contributions to $2,500 per year. In just over 14 years, you will have contributed $36,000 and received the full $7,200 in grant dollars. The most common strategy is the same as above, with regular contributions throughout the year. However, if you have the financial flexibility to do so, consider making a lump-sum contribution in January each year to maximize the time the funds are invested inside the tax-sheltered account.

Catch-Up Funding Model

This model is built around the idea that life happens, and not every year is going to go perfectly to maximize your contributions, or even to begin them ‘on time’! This model is likely the most common one used by Canadians, in some form or another. Children begin accumulating Assisted Contribution Room at birth, but many families either do not or cannot start saving for their education immediately. Luckily, the RESP rules allow you to ‘catch up’ on assisted contributions, with a maximum of $5,000 of Assisted Contributions in any year if you have enough Assisted Contribution Carry-forward Room.

Here’s two examples:

1) A couple has their first child, but due to job changes and moves are not able to start saving until their child is 9 years old. At this point, their child has accumulated $25,000 in Assisted Contribution Room ($2,500 per year from birth through age 9). The parents can now contribute up to $5,000 per year for the next 5 years to catch up on the original accumulated room. The child is now 14 and has continued to accrue the final $11,000 of Assisted Contribution Room over the past 5 years, so the parents can save $5,000 per year at age 15 and 16, and a final $1,000 at age 17 to have fully caught up to maximize Assisted Contributions and Grant.

2) A couple starts RESP savings for their child at birth, but is only able to save a few hundred dollars per year, increasing the amount after a few years, and then again after a few more. When their child is 10, they come into a windfall and realize they’ll be able to fully fund the RESP, but want to make sure they do it properly to maximize Assisted Contributions to attract the most amount of Grant.

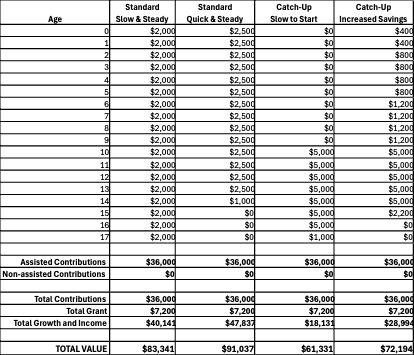

The following table demonstrates the differences between the four scenarios above. All of the scenarios maximize the Grant received. Assuming contributions are made at the beginning of the year, and a 6% annual rate of return, these plans have the following estimated outcomes:

Worth noting is the difference in final market values between the catch-up models, where starting earlier with anything significantly outperforms waiting to do more later! For the prudent investor, total time invested is as important as any other factor.

The best time to start is at birth; the second-best time is today!

RESP Bonus Strategies: Maximizing, Front-End Loading, and Super-Funding

These final strategies push the RESP to it’s limits, literally, by maximizing the total contributions to $50,000, beyond the Assisted Contribution level of $36,000. These describe the standard application, but can also be combined with catch-up models.

Maximizing

Contributions maximize both the total grant received and total possible contribution room, and are spread out evenly over the full 18 years to minimize / standardize the annual savings commitment.

Front-End Loading

Contributions maximize both the total grant received and total possible contribution room. A Non-assisted Contribution of $14,000 is invested in the first year to maximize the amount of time it is invested inside the tax-sheltered account.

Super-Funding

For those with the means to super-fund an RESP, the full $50,000 possible is put into the account and invested immediately. Contributions maximize both the total possible contribution room and the time invested inside the tax-sheltered account. This strategy does not maximize the Grant received.

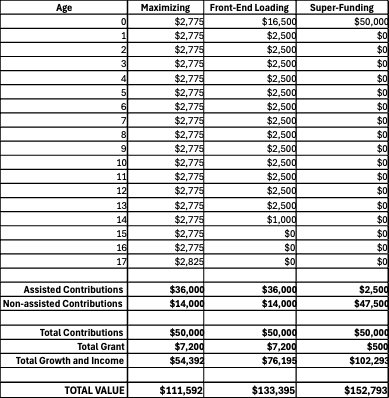

The following table demonstrates the differences between the three scenarios above. All of the scenarios maximize the Grant received, except for the Super-Funding strategy in the final column which only receives Grant money in the first year. Assuming contributions are made at the beginning of the year, and a 6% annual rate of return, these plans have the following estimated outcomes:

Whether slow or fast, starting now or later, super-funded or funded to the best of your ability, the RESP is a powerful, tax-sheltered savings account that requires an understanding of both how to fund it properly, and how to keep it safely invested.

If you have any questions about these Savings Strategies or if you’re approaching the time to start making withdrawals to fund your student’s education, please call or email and we can discuss the strategy that will be the most impactful for you.